Beginning in 2022, foreign nationals with tax residency status in China will no longer enjoy special tax deductions for benefits including housing rental, language training, and children’s educations. It’s widely expected that the policy change will increase the tax burden for a large number of foreign nationals in China.

For a long time, foreign nationals in China have enjoyed tax-exempt benefits such as housing rental, children’s education, and language training. However, according to the Notice on Converging Preferential Policies Following IIT Law Update (Caishui [2018] No. 164), foreign nationals will cease to enjoy the tax-exempt benefits on the aforementioned benefits, starting January 1st, 2022.

Housing rental, children’s education, and language training for foreign nationals will be taxed together with the basic salary. However, foreigners with taxpayer status in China will still be able to utilize the additional itemized deductions available to all resident taxpayers in China.

Note: Tax resident refers to individuals who reside in China for more than 183 days within a calendar year.

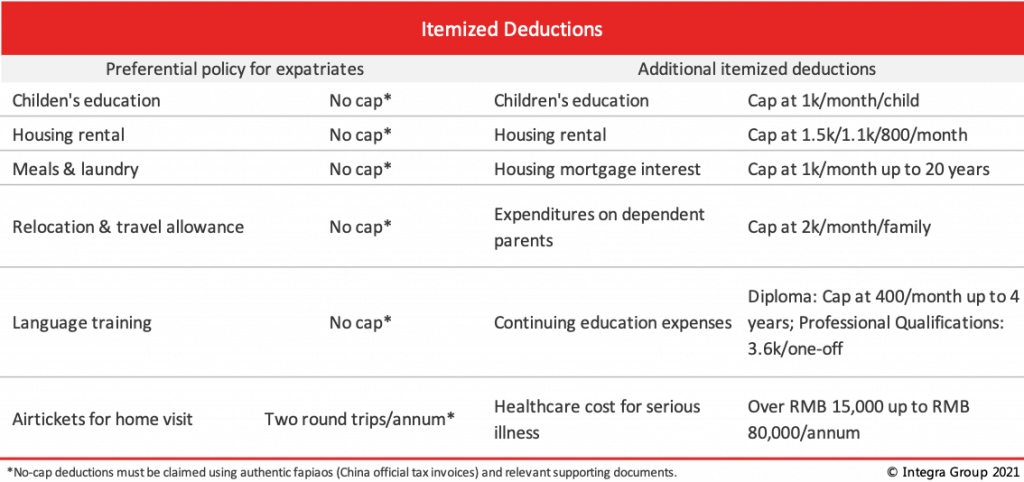

Tax Exempt Benefits for Expats in China (Preferential Policy)

Under the Notice on Implementation Issues for Individual Income Tax Collection on Subsidies Obtained by Foreign Individuals (SAT [1997] No. 54), foreign nationals with tax residency status in China can enjoy 8 tax-exempt benefits for the purpose of individual income tax.

The 8 categories of tax-exempt benefits for expats include:

- Housing rental

- Language training

- Children’s education

- Meal expenses

- Relocation expenses

- Laundry expenses

- Business travel

- Home travel

Notably, the 1997 notice by the State Administration of Taxation does not specify a limit to the amount of expenses that can be deducted within the 8 categories of tax-exempt benefits for expats. Foreign nationals have been allowed to fully deduct the aforementioned 8 categories of tax-exempt benefits based on their actual cost, provided the amount is “reasonable” and accompanied by a corresponding fapiao or other proof of payment.

In practice, a reasonable amount according to tax authorities has been known to extend up to 30-50% of the expat’s total salary.

However, starting in 2022 foreign tax residents in China will cease to enjoy the first 3 categories of tax-exempt benefits, namely housing rental, language training, and children’s education.

Tax authorities have not yet specified whether the remaining 5 categories (meal, relocation expense, laundry, business travel, and home travel) will continue to enjoy their tax-exempt status or not.

What are the additional itemized deductions?

All tax residents in China, including both foreign and Chinese nationals, can enjoy the following 6 categories of additional itemized deductions for the purpose of individual income tax, including:

- Children’s education expenses

- Continuing education expenses

- Housing mortgage interest

- Housing rental

- Healthcare costs for serious illness

- Expenses for supporting the elderly

However, unlike the tax-exempt benefits for expats, the additional itemized deductions are subject to deduction limits. Tax residents can only deduct an amount up to the limit for each of the 6 expense categories.

While several of the expense categories under the preferential policy for foreign nationals and the standard itemized deductions overlap, the key difference is with the amount that can be deducted.

Housing rental and children’s education are naturally high-cost items for foreign nationals living in China. Under the old policy, allowing foreign nationals and their employers to deduct these costs based on the actual expense so long as it was within a reasonable amount meant that employers could treat the cost as a staff welfare expense without significant tax liability.

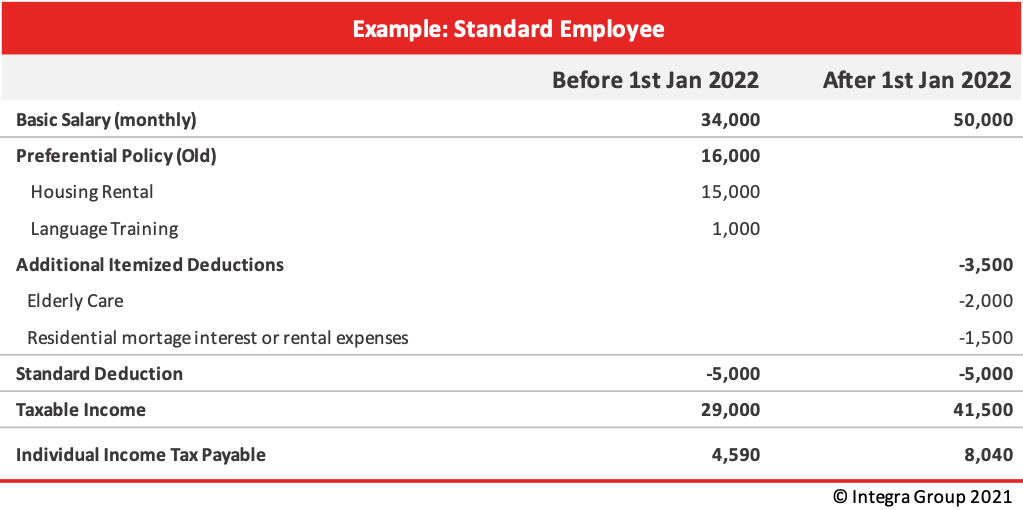

Example 1: Standard Employee

The following example demonstrates a standard employee hired in China. This employee does not receive any special benefits or allowances from the company as part of the terms of their employment. The employee provides their housing rental and language training contracts and corresponding fapiao to the employer to claim the income tax deduction under the old policy.

In the above example above for a standard employee, the foreign national is making use of the preferential policy primarily as a personal tax planning measure. Under the given circumstances, the foreign employee tax liability will increase by RMB 3,450 or 75.2%.

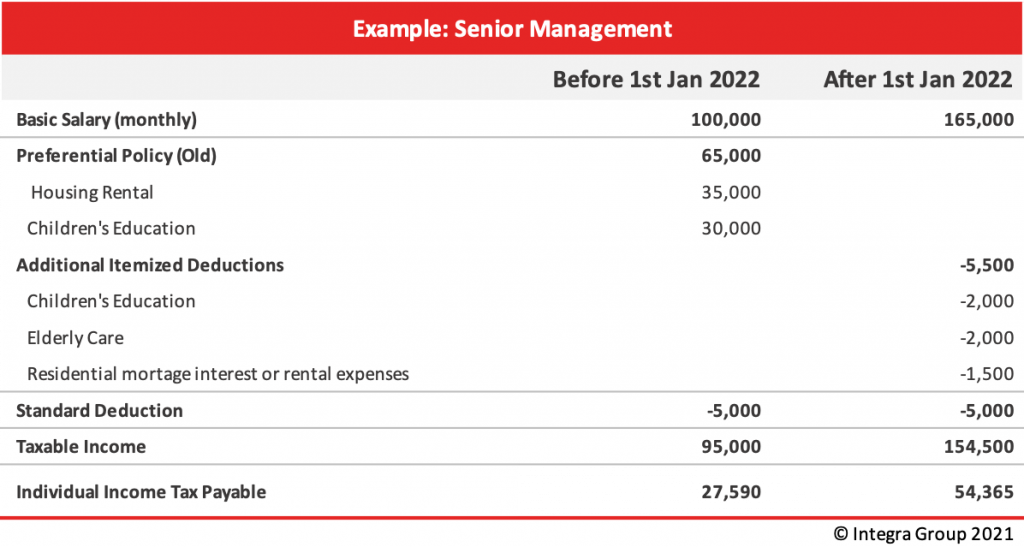

Example 2: Senior Management

The following example demonstrates a foreign national dispatched to China together with their spouse and two children to serve in a senior management position. The company shall provide housing and education for the two children as part of the terms of their employment.

As demonstrated by the example above, for someone earning enough income to pay tax in the 35 or 45% tax bracket with kids going to private school, the foreign national’s tax liability will increase by RMB 26,775 or 97%.

Without the tax exemption for costs like children’s education, employers will likely more carefully consider relocating foreign nationals with children to China to serve in senior management positions. Moreover, foreign nationals with children in China may consider the competitiveness of their total compensation under the new policy or consider making lifestyle changes to adjust to the new policy.

Tax Planning for Expatriates in China

Come January 1st, 2022 foreigners have fewer tools at their disposal for tax planning purposes and are likely concerned about the impact to their total compensation or the competitiveness of their employment. It’s widely expected that with the current situation many foreign nationals will see an increase in their tax payable following the policy change.

For standard employees without substantial tax-exempt benefits, the policy change may be bearable by either the employee or the employer. Foreign nationals with high income and significantly larger tax-exempt benefits will find the higher tax payable more difficult to accept.

Relocating to a more favorable tax jurisdiction

Employers may consider moving part of their business activities and certain employees to areas that provide more favorable tax incentives for individuals, such as the Greater Bay Areas (Guangdong, Hong Kong, and Macao) or the Hainan Free-trade Port, where income tax is capped at 15% or below.

Given China’s relatively high tax ceiling of 45% for individual income tax, some individuals may consider looking for more favorable employment opportunities in the Greater Bay Area themselves or even relocating to another country where they may find better job opportunities.

Registering a new company

reIn China, the tax ceiling for individual income tax is 45% whereas the tax ceiling for dividends paid to foreign individual shareholders is 0%. Foreign shareholders may choose to pay profits as a dividend rather than a salary. High-income foreign nationals may also consider registering a new company to collect service fee’s which can be paid as a mix of dividends and salary.

Registering a new company introduces new compliance and statutory requirements. Please seek the advice of a tax professional or corporate service provider.

How employers and employees in China should prepare

It’s firstly important to determine whether the tax liability should be borne by the employee or employer according to the labor contract. If the contract states an after-tax salary amount with benefits paid by the company, the company will be responsible for the tax payable. On the other hand, if the contract states a before-tax amount the employee shall be responsible for the tax payable.

In many cases, benefits or allowances such as housing rental, children’s education, and language training do not specify whether the amount is before- or after-tax. In this case, employees and employers can treat it the same as salary in relation to the tax liability.

Many foreign nationals in China will find the higher tax liability difficult to come to terms with. Employers who do not show concern for their employees’ livelihood are likely to lose favor with their employees in the long term. Employers can choose to act proactively and renegotiate the terms of the employment contract and total compensation package under the new policy to retain their foreign employees.

Employers may also enlist a tax specialist to assist expatriate employees in utilizing their available tax planning methods and provide guidance to the organization on steps it could take to help employees manage their tax liability.