China has long maintained strict foreign exchange controls over funds leaving the country, meaning foreign investors face a series of compliance challenges before they can successfully move funds out of the country.

With the current pace of regulatory changes and with the banks adopting different anti-money laundering procedures, foreign investors in China are naturally concerned about their ability to move funds and most importantly, repatriate profits to their home countries.

Foreign investors in China are advised to use the various methods available to them to best optimize the tax liability resulting from funds leaving the country. In this article, we discuss the four primary ways for foreign-invested enterprises (FIE) to repatriate profits as well as applications of transfer pricing in China.

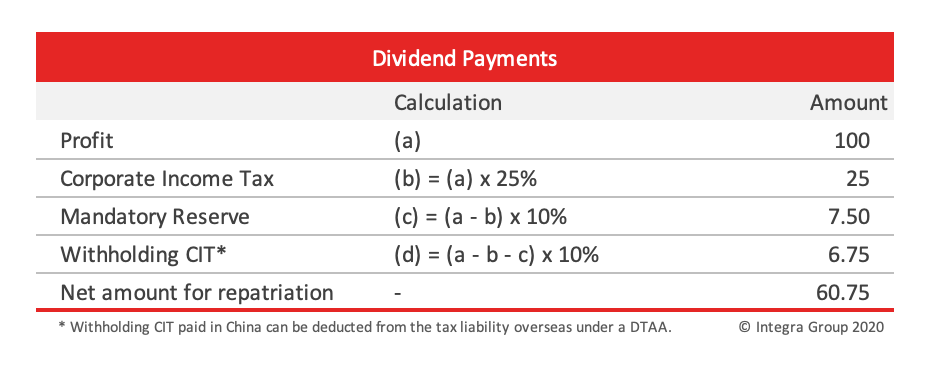

Profit repatriation by dividend

Dividends to shareholders are the most commonly utilized method for FIEs in China to repatriate profits to foreign entities – despite being a fairly costly method for repatriating profits.

Dividends can only be paid from after-tax earnings following the annual CIT reconciliation – i.e. the annual tax filing – typically in May of the following fiscal year. The relevant tax authorities will confirm the total amount of profits which can be paid as dividend and whether all previous year’s losses have been made up.

Additionally, FIEs who wish to repatriate profits must place at least 10% of net profits in a reserve account – up to a limit equal to 50% of the registered capital. Reserve funds can be used to cover future losses, cover operating expenses, or be reinvested in the business at a later date.

China provides various tax benefits that lower the taxable corporate income – such as those enjoyed by qualified micro, small, and medium-sized enterprises. These effectively increase the amount of retained earnings which can be paid as dividends making it a more efficient means of repatriating profits

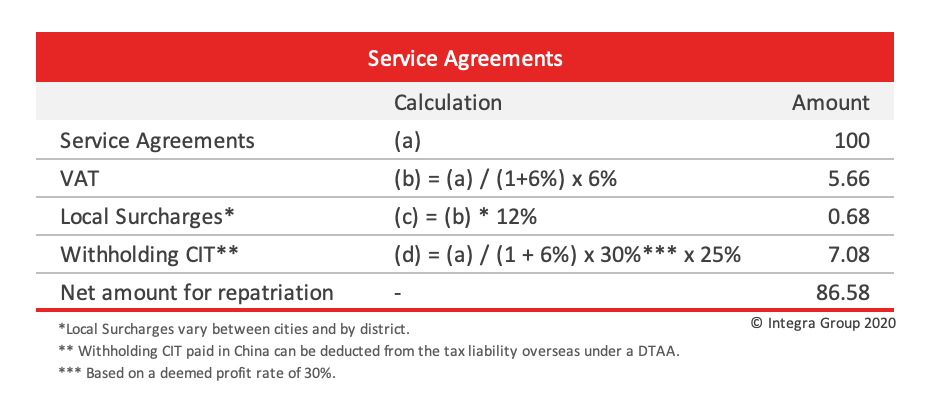

Service fees

Certain business functions may be carried out at the group company level or by a related party in exchange for a service fee. Some examples include accounting, HR, information technology, marketing, and other supporting functions that can be administered at the group level. For service fees paid to overseas, the China entity must withhold CIT, VAT and other local surtaxes on behalf of the overseas entity. CIT is calculated based on the standard 25% CIT rate and a deemed profit ranging from 15% to 30% for revenue from project operations, design and consulting services, and 30% to 50% for revenue from management services.

The process of engaging in intercompany service agreements has become simpler in recent years. However, given their potential for misuse, tax authorities reserve the right to call into question the validity of intercompany service agreements. It’s important that the necessary tax compliance steps be taken to ensure such agreements are done in compliance with PRC laws and regulations should they be challenged by Chinese authorities.

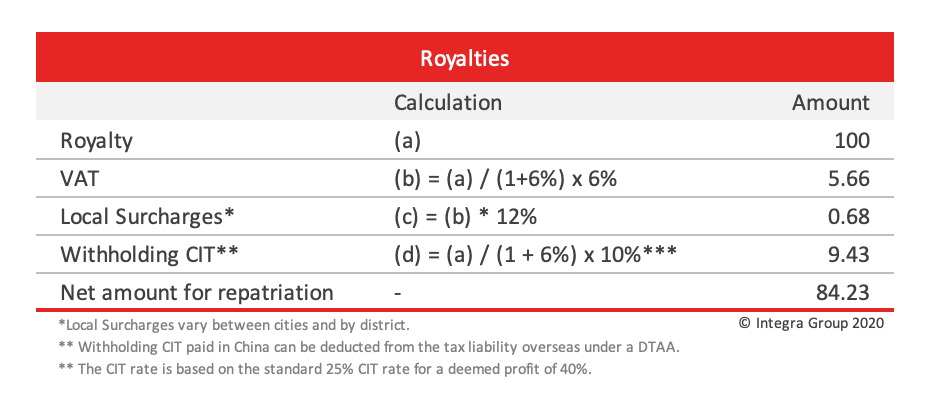

Royalties

Royalties are fees paid to an entity concerning the use of intellectual property such as patents, copyrights, trademarks, or proprietary technologies. When paying royalties to an overseas entity, the China entity is required to withhold CIT, VAT, and local surcharges before payment out of China can be made. Royalty agreements must also be registered with the trademark bureau and detailed royalty agreements provided, including the rationale for calculating royalty fees.

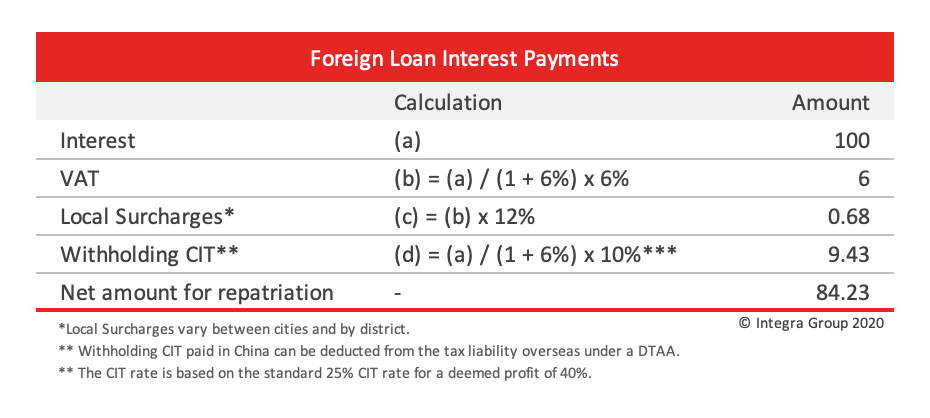

Foreign Loan Interest Payments

FIEs in China are permitted to register foreign debt – up to the Foreign Debt Quota – on which they can pay interest to the issuer of the loan. FIEs are permitted to pay interest at a rate not exceeding the official interest rate provided by the Bank of China – generally around 4%.

In order to utilize foreign loans, the business must specify a total investment which is greater than the registered capital on their Articles of Incorporation and register the foreign loan with the State Administration of Foreign Exchange.

Businesses may decide – within their allowed limits – how much of the total investment they wish to register as a foreign loan. Like with royalties, the China entity is required to withhold CIT, VAT, and local surcharges before payment out of China can be made.

The importance of DTAA’s

Double Taxation Avoidance Agreements (DTAA) signed between China and other countries provide relief from the double taxation of income, assets, or financial transactions. They allow for tax credits to be claimed overseas up to the amount paid in tax in China – and vice versa.

In some cases, DTAAs effectively reduce the tax withholding rate from income or other financial transactions between China and foreign countries. For example, the DTAA between HK and China effectively reduces the withholding CIT for dividends from 10% to 5% for shareholdings over 25%.

Tax residents of jurisdictions that have a DTAA in place with China may also be granted CIT exceptions and other preferential treatment for intercompany service agreements. However, these are only available on a case-by-case basis and subject to pre-approval of the relevant tax authorities.

When determining a profit repatriation strategy, investors are encouraged to carefully review DTAAs in place – if one is in place – between China and the shareholding jurisdiction before making a final investment decision.

How Transfer Pricing works

Transfer Pricing is an accounting practice for establishing the price of goods or services exchanged between two related companies. Transfer pricing is an important concept for multinationals as it allows companies to fairly distribute earnings amongst groups or related parties.

However, due to the potential for misuse or unfair pricing, the tax authorities will often carefully examine both parties involved in such transactions focusing in particular on;

- How each party benefited from the transaction;

- The necessity of services in question;

- The rationale for determining the price – was it done in accordance with the Arm‘s Length Principle?;

- And in the case of royalties, how much value the company derived from the use of the intangible assets.

Thus, it’s important that intercompany transactions are accompanied by detailed supporting evidence and are carried out in compliance with PRC law should they be challenged by the tax authorities.

Additional Considerations

When choosing methods of profit repatriation, one must consider the options available to their unique business situations keeping in mind that the tax authorities in China reserve the right to question the validity of many of the methods discussed. It’s also important that the business conducts thorough cashflow forecasts before repatriating profits to avoid needing to further increase its working capital in the future should it need additional funding.

Should qualified non-resident foreign decide to invest in industries outlined in the Catalogue of Encouraged Industries for Foreign Investment entities, PRC tax law provides a special deferral of withholding CIT derived from resident companies in China. To take advantage of the full range of profit repatriation methods available and achieve an optimal tax liability, foreign investors are encouraged to plan ahead.

Contact us for more information on profit repatriation methods and applicability to your business’ unique circumstances.