Registering a Foreign Invested Enterprise (FIE) is the first step in your journey of doing business in China. During the setup process, foreign investors must make some important decisions that will determine their allowed business activity and impact the taxes they pay.

Properly forming an FIE in China requires investors to understand the implications of the decision they make early on. Below you will find the key elements of registering an FIE in China and how to decide what is right for you.

Entity Type

Three main types of FIE exist in China, each with their own characteristics and intended purpose.

Wholly Foreign-Owned Enterprise (WFOE) – is the most common legal entity type for foreign investment in China and is suitable for most forms of business ventures. WFOEs can hire local and expatriate employees and engage in commercial business activities in accordance with their business scope.

Joint Ventures (JVs) – are legal entities with shared ownership between two or more parties. Equity Joint Ventures (EJV) share risk and return equal to an investor’s share of ownership. Co-operative Joint Ventures (CJV) share risk and reward according to the terms of a contract – allowing for more structural flexibility over an equity joint venture. EJVs can sometimes provide foreign investors access to industries restricted for foreign investment.

Representative Office (RO) – are not considered legal entities in China but instead as an extension of oversea entities. Their intended purpose is to liaise with local parties and coordinate promotional activities in China on behalf of their overseas head offices and therefore cannot engage in commercial businesses in China. They can hire employees using a third-party HR agent and are taxed based on their costs.

Business Scope

The business scope is defined by the business and submitted for approval by the State Administration for Industry and Commerce (SAIC). The business scope plays an important role in China as it determines the types of business activity the business can legally engage in and the items which the business can provide a VAT invoice (fapiao) for.

When determining the desired business scope, foreign investors should create an exhaustive list of the products and services that they wish to offer and align their descriptions with the official Industry Classification.

Business activities in China are classified as either “Prohibited”, “Restricted” or “Encouraged” according to the “FI Encouraged List”, “FI Negative List”, and the “MA Negative List”.

Encouraged industries are often eligible for preferential treatment and tax incentives whereas restricted industries are subject to special conditions such as shareholding limits as well as special approvals by the government. Prohibited industries are entirely off-limits for foreign investment. Industries that do not appear on any of these lists grant equal market access to foreign investment as domestic investment.

FI Encouraged List – Catalogue of Encouraged Industries for Foreign Investment (2019) (available here)

FI Negative List – Special Administrative Measures on Access to Foreign Investment (2019) (available here)

MA Negative List – The Negative List for Market Access (2019 edition) (available here)

Industry Classification – The Industrial Classification for National Economic Activities (available here)

Legal Persons

When registering a business in China, there are three mandatory legal person positions that must be fulfilled. There are no restrictions – such as nationality – or qualification for who can hold these positions.

Legal Representative – is the most important role in the company as they are the default authorized signatory. Typically, this is the sole investor themselves, or a person designated by the executive director or board of directors of the China company.

Executive Director – is appointed by the shareholder to manage the company. Investors can also appoint a board of directors which must consist of 3 or more persons. For small businesses, the executive director is typically the same person as the legal representative.

Financial Responsible Person – is a mandatory position and cannot be the same person as the Legal Representative or Executive Director. Typically, this is the company’s internal finance manager or a third-party financial services provider.

Supervisor – is also a mandatory role and cannot simultaneously hold any other legal roles within the company. The supervisor should be independent of the daily operations of the company. This role is normally fulfilled by the CFO or a legal counsel to the investor company. You can imagine the supervisor is like an auditor who may examine the books and records of the China company to ensure full compliance of (both external and internal) rules and regulations.

Registered Capital

The amount of registered capital – together with the total investment – is defined on the Articles of Association submitted by the investors during the business license application process. It is the initial funding required to get the business started.

For most business types, there are no minimum required capital requirements, unless otherwise specifically set out in laws, regulations, or State Council decisions currently in effect. Investors are not required to inject the full amount of registered capital upon registering the company – nor is the registered capital required to stay in the bank account. It can be spent on capital assets like machinery and equipment or operating expenses like inventory, salaries, rent, etc.

The period for which capital can be injected normally is dictated by the company’s articles of association – up to the life span of the company’s operating period. Thus, the registered capital can be injected over time in order to meet a business’s financial obligations. For SMEs, we recommend as a ‘rule of thumb’ to estimate 6 months’ worth of operating expenses and asset purchases as the declared registered capital.

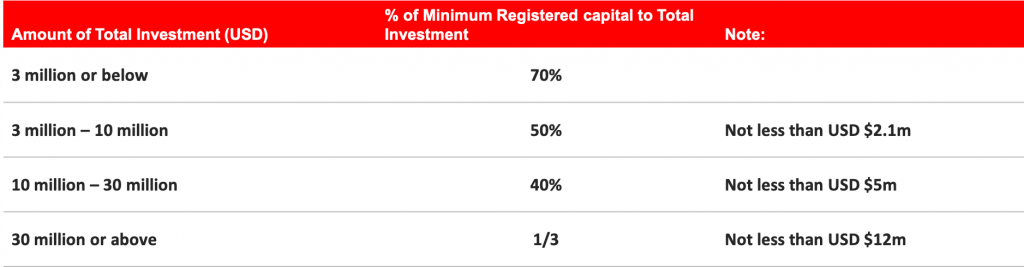

Foreign Debt Quota – is the difference between total investment and registered capital and is capped by the State Administration for Industry and Commerce (SAIC). Foreign debt allows investors to provide short-term or long-term funding to the business to help it meet its financial obligations.

Other Issues

There are several other issues that investors should be aware of when registering their business.

Company (Chinese) Name– need to contain four elements; the unique business name, industry description, location, and legal form. The industry description, location, and legal form are determined by the nature of the company and cannot be freely decided upon. The unique business name is up to the discretion of investors. It’s important to remember that the business name is printed on official VAT invoices and engraved on the company’s seal, so it’s generally a good idea to choose something which is simple.

Bank Accounts – All businesses in China are required to have at least two bank accounts; the capital account, for depositing the registered capital, and the RMB basic account for day-to-day business operations. Foreign businesses might also require foreign currency accounts which are separate accounts.

Registered Address – In order to complete the company registration process, businesses must have a valid rental contract to which their business is registered. Some districts allow multiple addresses business to a single address, so make sure to check whether the district you wish to register in allows this before deciding to rent shared office space. It is important to know that the operation address should be the same as the registered address in which you operate, as this dictates where your taxes and business affairs are being conducted within the district.

Common Mistakes

One of the common mistakes investors make when registering their FIE in China is selecting a business scope that is not suitable for their planned business activities. For some industries, a business scope that is too generic may prevent the FIE from obtaining preferential policies or tax incentives. On the other hand, a scope which is too narrow can prevent the business from issuing VAT invoices for specific product or service categories.

Another common mistake by investors is allocating too little registered capital. FIEs in China may find it difficult to apply for a bank loan as it lacks a credit history and no assets to pledge against. The registered capital becomes the primary source of funding for the business until it is cash flow positive. Allocating too little registered capital can prevent investors from providing additional funding in the form of capital injection and financing (i.e. the investor providing loans up the foreign debt quota) in order to meet their financial obligations.

These issues can be addressed by making changes to the business license, though this takes time and a cumbersome process to complete. Investors are advised to carefully consider the details of their registration application – and seek the help of a professional if needed.