When negotiating sales contracts with clients, terms surrounding the “three flows” have a significant impact on the tax liability and cash flow of your businesses. It’s important to know how these “three flows” work, and the cash flow implications that arise when negotiating these terms as part of your Chinese sales contracts.

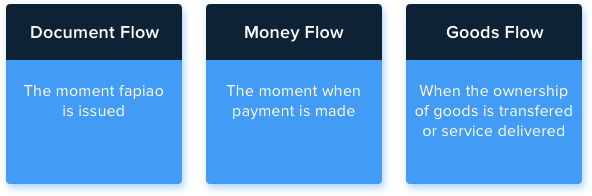

The “three flows” refer to; 1. “Document flow” i.e. fapiao, 2. “Money flow” i.e. payment, and 3. “Goods flow” i.e. transfer of Goods/Service.

How to make Chinese sales contracts favor your business

The three flows are the key events which you need to look out for in order to know when your business’ tax liability is realized. We will show you when would be most ideal for your business to schedule these events. We can’t advise you on when to deliver goods, or how to structure your payment terms because these vary significantly between businesses. Instead, we focus on how you can manage fapiaos as to avoid paying tax early and maximizing your business’ available cash at any given time.

Fapiaos are often overlooked and are often thought of as minor details in a Chinese sales contract. After reading this article you will know how fapiao terms can be seen as a negotiating chip to negotiate larger deals with your clients and favorable tax terms for your business.

China is different from the rest of the world. We’ve said in past articles that fapiaos are the gold standard as far as the tax authorities are concerns. There´s one rule which is always true; if you issue a fapiao, your VAT liability stated on the fapiao will be due in the same period. That means, once the transaction has been recorded on a fapiao, it’s official, your VAT is due.

It’s important that you don’t issue fapiao’s early. Not only does this force you to recognize your tax liabilities early; it’s also one of the indicators to the tax bureau that a business is engaging in fraudulent tax manipulation activity. If the total fapiao revenue is higher than the revenue declared on your tax filing within a single period, you may get your tax device locked until further notice.

Below is our advice to you on how to structure your chinese sales contracts to plan your fapiaos in a way which is favorable to your business.

Scenario 1: Direct Sales

The most common scenario which businesses face is when the flow of goods and the flow of payment occurs in the same accounting period. Chinese tax law states that if these two events have occurred, VAT liability must be recognized in the same period. It is not allowed to delay VAT liability arising from the transaction if both the ownership of good has been transferred and money received. Not declaring your VAT liability would be considered unlawful manipulation of tax liability.

A common mistake we see is when a business’ accountant performs bookkeeping on the basis of fapiao in which case, it’s very common that accountants don’t become aware of transactions for which a fapiao has not been issued or issued late. You would unknowingly be manipulating your tax liability which carries a financial penalty to the business.

Read our article about Fapiao Accounting on how to avoid accidentally manipulating your taxes.

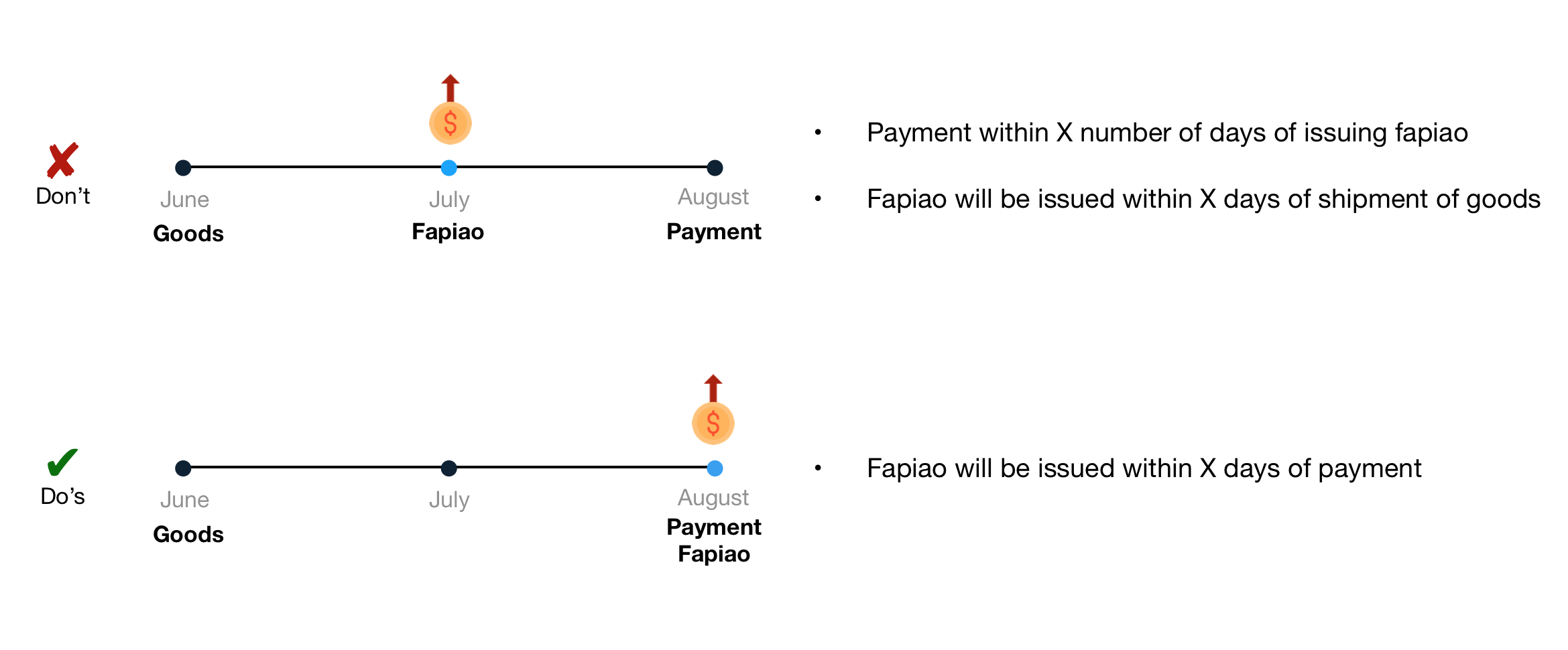

Scenario 2: Credit sales

Let’s say that you allow your customers favorable payment terms in order to win the contract. The terms in your Chinese sales contracts might allow the customer to pay 30 days after goods or service have been delivered. In this scenario, you don’t want to pay tax on top of the line of credit you give to your clients before receiving payment yourself. Recognize your VAT liability after receiving payment for goods sold on credit is much better for a business’ cash flow.

Below are some common contract terms resulting in you paying tax early;

- Payment within X number of days of issuing fapiao

- Issuing fapiao along with goods or service

Instead, we recommend you use the following contract terms for sales on credit;

- Fapiao will be issued within 3 days of payment

The contract must explicitly state that delivery of goods is on the basis of credit along with specific payment terms to allow the business to recognize its VAT upon receiving payment. This will ensure that you are not required to pay the tax on goods for which you have not received payment for. If you do agree to your client’s request to issue fapiao early, be aware that this will cause you to pay 6-16% (VAT) of the contract value in advance.

It’s also worth noting, that if the input fapiao was not delivered to you by your supplier, it’s not possible to deduct the input VAT. Issuing the fapiao (“output fapiao”) before input fapiao is received causes you to pay the full VAT amount, resulting in a higher total tax payment.

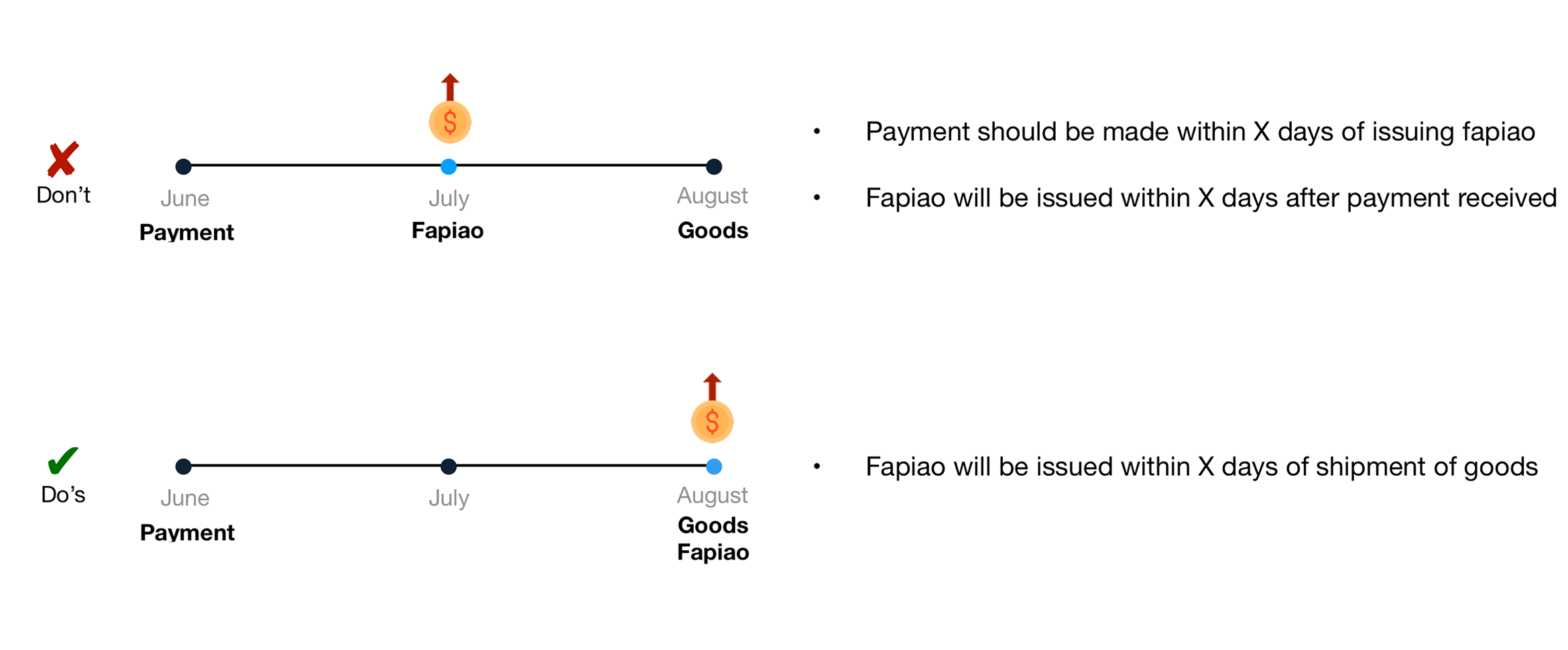

Scenario 3: Pre-payments or deposits

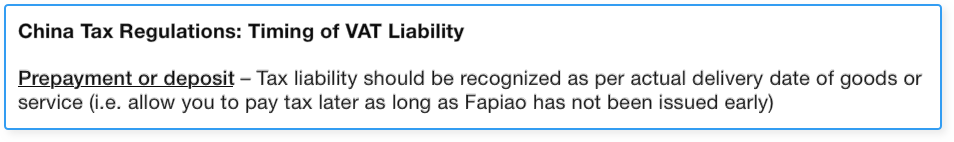

If you receive payments in advance for future delivery of goods or service, you might be tempted to issue a fapiao because you feel certain that you will do so in the future. Doing so would be paying VAT on liabilities (prepayments & deposits) which have not actually become revenue for your business yet.

Technically speaking, a fapiao is not supposed to be issued at this stage because no transaction has been completed. Included in PRC Tax law are guidelines allowing the fapiao to be issued along with the good or service being delivered for this reason.

In the prepayment scenario, we recommend negotiating with your clients to try to agree on issuing fapiao along with goods or service, instead of upon payment.

There are however many scenarios which a client might request a fapiao before goods are delivered. Agreeing to these terms has several benefits to your client. By issuing a fapiao early, your client is able to deduct the costs from their revenue early and potentially avoid some large corporate income tax payments on their side. They are also able to reduce their VAT payable by deducting the input VAT.

It’s very common for clients to ask for fapiao in advance. Knowing that by agreeing to issue fapiao before goods are delivered you are making concessions in exchange for benefits to your clients. This knowledge could be useful to negotiate larger deals or favorable contract terms for your business in the future.

No funny business when it comes to fapiaos

Business in China requires flexibility. However, when it comes to whom you issue a fapiao to, there is very little flexibility. A fapiao must be consistent with the real transaction and the supporting documents in order to be a qualified business expense. An unqualified fapiao might come back to cause you trouble if you discover that your client was engaging in some fraudulent behavior.

Avoid the most common scenarios that could cause trouble for your business;

- Issuing a fapiao to a different legal entity than on the contract

- Receiving money from a personal bank account and issuing fapiao to a business.;

A checklist for Chinese sales contracts

Here is a simple checklist to follow when creating new contracts or revising old contracts to help managers manage their tax liability in China. Revisit this list, along with any other important terms to your business, each time a client sends you back a contract.

1. Fapiao information

It’s important that you specify on sales contracts the details of the fapiao. This should include whether you will issue a Special VAT fapiao or General VAT fapiao to your client. A Special VAT fapiao save your client 6-16% of the total amount in the form of tax deductions. This is not only important to your client but also you as to avoid price-matching a competitor who is a “small-scale” taxpayer, who is subject to 3% VAT tax, which in most cases is non-deductible for VAT purposes.

Secondly, make sure to include complete and accurate fapiao information including; legal name, tax ID, bank account information, registered address and telephone number of the client. This will ensure your client’s deductions are qualified. Void or reissue fapiao will be time-consuming for your accountant, especially for the Special VAT fapiao which are strictly controlled by the tax authorities.

2. Is the price tax inclusive, or tax exclusive?

This might seem simple, but if any dispute arises with one of your clients, not specifically stating in your contracts whether the price is tax inclusive or exclusive could create problems for your business.

3. Does the price include all surcharges? (Insurance, freight fee, packaging, etc.)

Make sure that your contracts detail ownership of all surcharges including; insurance, customs and duty, freight, and packaging.

4. Make sure to separate goods & services.

In China, goods most often taxed at 16% and services at 6%. This means that if the transaction is a mixture of goods and services, combining this into a single product would force you to pay the highest VAT tax rate. Make sure to clearly separate the cost of goods and cost of services.

5. Timing of 3 flows.

Make sure to specify in the sales contract the timing of the three flows; goods, fapiao and payments. This helps ensure that when your VAT liability will be recognized is clear in advance.

Conclusion

Clients often ask for special terms and businesses have to make concessions on contracts sometimes. However, knowing how these terms affect your business is critical. An external bookkeeper will likely never offer advice on how to optimize your contracts to improve your cash flow and manage your tax liability. It’s important that tax planning be included in your finance manager’s scope of responsibilities.

Alternatively, a virtual CFO serves as your financial professional and tax planning specialist when setting terms for your Chinese sales contracts. When everything is on the negotiating table, make sure you do not forget to negotiate favorable tax terms for your business.