Whether it be a multinational corporation with operations in various countries or an early-stage business, investors and business operators are naturally concerned about the amount of tax they pay. Businesses aim to achieve greater tax efficiencies and improve cash flow through effective tax planning. However, when operating in overseas markets a key challenge is always navigating the various local tax laws and regulations that apply to the business and its activities.

Tax planning is the means by which businesses regularly assess and strategically manage the tax liability arising from their business activities. Generally, this includes Corporate Income Taxes (CIT), Value-Added-Tax (VAT), and Individual Income Taxes (IIT). As the complexity of a business increases, so does the tax planning considerations. Here we share some of the key tax planning considerations for businesses of all complexities to guide foreign investors in China.

Company Setup Tax Planning

During the company setup, the business owners must make several decisions that affect the future tax payables of the business.

Taxpayer Status

Applying for small-scale VAT taxpayer status allows businesses to apply a flat 3% VAT rate for both products and services – as opposed to the standard 6% (servicing) and 13% (product trading) of General VAT Taxpayers. However, small-scale VAT taxpayers are not allowed to offset their VAT payable using input VAT deductions (or tax credits). Instead, they pay a flat 3% VAT on gross sales revenue.

Determining which taxpayer status is more efficient varies case by case depending on several factors including the amount of estimated input expenses, whom your suppliers are, the expected turnover of the company, and more. We suggest working with a professional tax accountant to determine the most efficient taxpayer status based on individual circumstances.

Read More: An Overview of the PRC Tax System and Administration

Business Scope

Tax rates vary between products (9% – 13%) and services (6%). Separating products and services allows businesses to apply a lower tax rate for revenue generated through services. Generally, both product and service business scopes can be applied for under a single business license. However, in some cases where it is difficult to separate the service from the product – such as software – the company may be required to register two separate companies to effectively apply a lower tax rate.

Additionally, in order to qualify for various preferential policies and incentives, businesses must meet a specified business scope. The business scope cannot be too broad, or it might affect their ability to apply for preferential treatment and incentives.

Preferential policies and incentives

There are various preferential policies and incentives provided in China including – reduced tax rates, special “super deductions”, tax holidays, reduced interest rates, cash incentives, and other fiscal stimuli. Preferential policies follow the current economic agenda outlined in the various “Encouraged Catalogues” and can change frequently. Generally, they are awarded based on the following factors:

Business activities – such as infrastructure investment, high-new technology enterprises (HNTEs), and other industry sectors which meet the economic and social development needs of each region.

Location – such as Free Trade Zones, High-Tech parks, Belt and Road Initiative (BRI) areas, and other areas outlined as “in-need” for investments (Example: China’s Western Regions).

The first stage of applying for preferential tax treatment and incentives requires you to engage with an advisor to determine whether your business meets the qualifications set out by local jurisdictions. In some cases, the criteria are clearly laid out and other times this involves liaising with the relevant regional authorities over the permissible business activities and incentives.

Micro- and Small Sized Enterprises

Micro- and Small Sized Enterprises (MSEs) are defined as “having a relatively small size in personnel and scope of business”. The standard for classification of MSMEs is based on the industry, operating income, total assets, and the number of employees belonging to a company. Over 95% of all Chinese businesses classify as MSEs.

Various preferential tax policies are targeted to China MSEs and effectively reducing the tax payable up to prescribed limits, including;

- The first RMB 1 million of taxable income will be taxed at a preferential CIT rate of 20% for 25 percent of their income, with the remaining 75 percent tax-free.

- Taxable income for the next RMB 1 million to RMB 3 million will be taxed at a preferential CIT rate of 20% for 50 percent of their income, with the remaining 50 percent tax-free.

- Taxable income above RMB 3 million will be taxed at CIT rate of 25%.

- Small-scale VAT taxpayers with monthly revenue of less than RMB 100k will be exempted from remitting VAT on certain items

Daily Tax Planning

The transactions a business engages in on a daily business not only have an impact on the cash flow, but also the underlying tax liability of the business. Effectively managing the taxes you pay requires an understanding of how transactions are recorded and their related bookkeeping procedures. Below are some tax planning matters to be considered:

VAT planning

China’s official VAT invoices (fapiaos) play an important role in the daily tax planning of businesses. Once a fapiao is issued, the resulting VAT payable is due upon the next VAT declaration.

Chinese businesses are required to self-declare and pay their VAT monthly or quarterly depending on their taxpayer status. However, special transactions – such as overseas remittances – can require the business to pre-pay VAT.

Generally, businesses should be mindful when issuing fapiao and carefully monitor each invoice to avoid issuing duplicate fapiao. Good practice is to specify in sales contracts when a fapiao is issued and align those terms with the collection of sales revenues. Businesses should also be mindful of purchase contracts and request fapiaos be issued together with the payments made to those suppliers.

CIT planning

Taxable income – i.e. income subject to CIT – is revenue minus qualified expense deductions. Regardless of whether the company made a profit, an unqualified deduction can result in the business paying CIT on some of its expenses.

Expenses entered into the financial records without an accompanied fapiao, or an unqualified fapiao attached are considered to be unqualified expenses. It is important the business maintains up-to-date financial records and implements procedures to ensured supporting fapiao are qualified ones for good accounting practice.

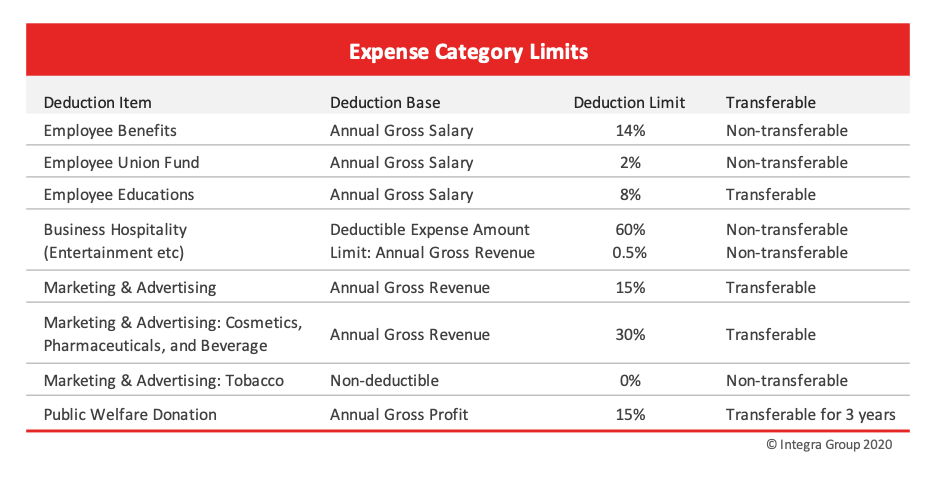

The deductibility for certain expenses is limited based on the thresholds set by the tax authority (see table). Expenses beyond these limits are required to be “added back” for income calculation purposes and are subject to CIT. It is important to monitor these tax-deductible thresholds and be mindful of the additional tax payable above these limits.

Benefits of tax planning

Tax planning has many benefits for companies of all sizes ranging from operational cash flow benefits to a lower underlying tax liability. Companies are advised to consider the tax planning methods discussed and adopt policies to monitor their tax payable regularly. A majority of businesses, especially MSEs, can enjoy the benefits of tax planning using these methods.

The tax planning methods available to companies of a degree of size and complexity go beyond those discussed here. These include businesses with large R&D expenditure, multinational companies with subsidiaries in China and overseas, and companies with a mix of both services and products. Companies that meet these general criteria should spend more time exploring the tax planning options available to them and how they can maximize their benefits.

For more information about tax planning in China and assistance with applying these methods, businesses are advised to speak with a professional tax accountant or advisor.