China is one of the biggest markets in the world and is attracting more foreign investors to enter the Chinese market to pursue new opportunities. In order to achieve an overall greater return on investment and minimize risks, investors need to fully understand the People’s Republic of China (PRC) tax system and the associated costs before making a final investment decision.

Below we provide an overview of the PRC tax system and administration to provide investors background information on the associated tax costs of doing business in China. We also discuss some of the business activities which do not involve direct investment within China and the applicable taxes triggered by these types of activities.

The information provided does not cover taxes levied in Hong Kong and Macau which are special administrative regions of the PRC. Hong Kong and Macau retain their own tax systems and the taxes applicable in Mainland China do not apply in Hong Kong and Macau.

PRC Tax Categories

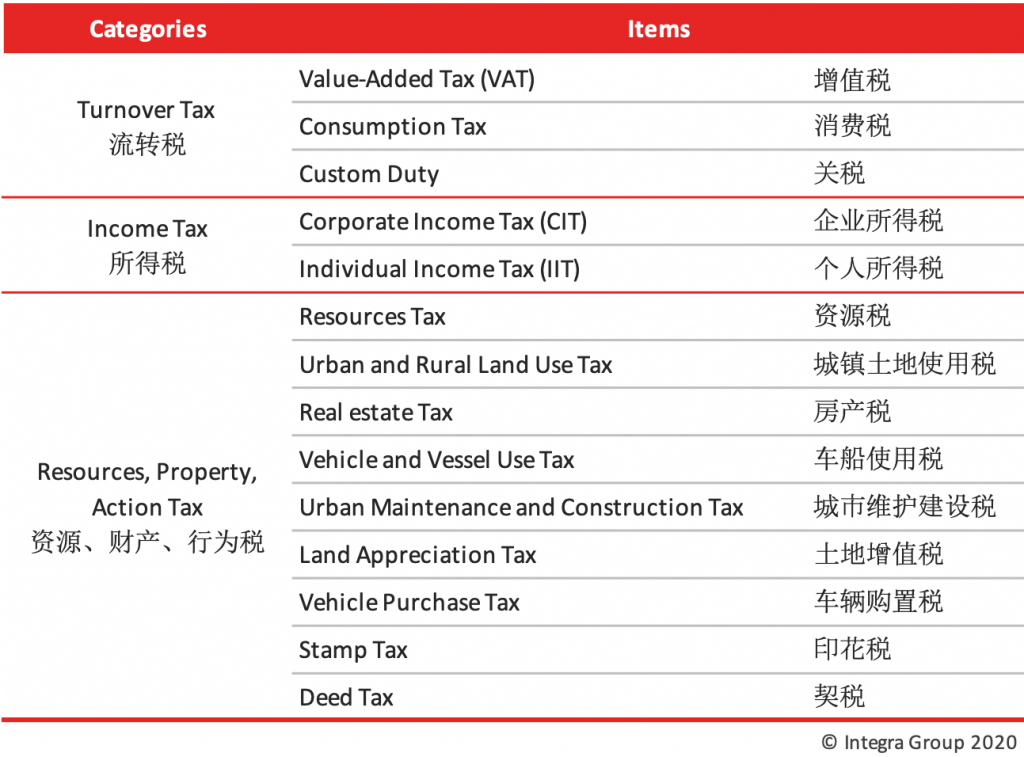

The major taxes applicable to foreigners, foreign enterprises (FEs) and foreign investment enterprises (“FIEs”) doing business in China are as follows:

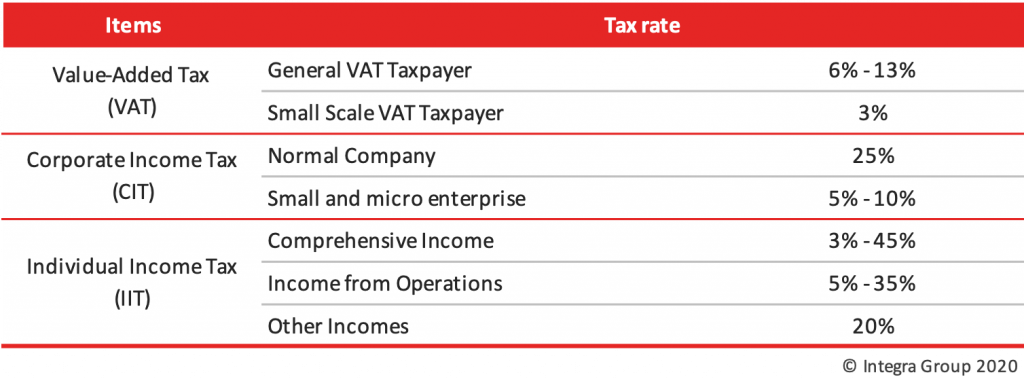

Value added tax (VAT) – The sales or importation of goods, provision of services, sales of intangible assets or real estate, are subject to VAT. VAT rates depend on the business scope; sale of goods (13%), special sectors (9% – 10%), and services (6%). Businesses can also register as a small-scale VAT taxpayer and apply a flat VAT rate (3%) levied on total revenue but prohibit the use of input VAT deductions.

Customs duty – applies to imported goods and is based on the value of the transaction or specific duty (e.g. RMB 80 per unit or per kg). The applicable duty rates depend on the category of goods and the country of origin.

Consumption tax – is levied on manufacturers and importers of specific consumer goods such as alcohol, tobacco, cosmetics, jewelry, fireworks, gasoline, automobiles, luxury watch etc. The tax liability is computed based on the sales amount and/or the sales volume depending on the goods concerned. Consumption tax is imposed in addition to applicable Customs duty and VAT.

Corporate Income Tax (CIT) – is levied on the net profit of the company. Generally, the CIT rate is 25%. The qualified new/high tech enterprises are applicable to the reduced CIT rate of 15%. For “Small and Micro Enterprises (SMEs)”, CIT rates range from 5%-10% depending on the total revenue.

Individual Income Tax (IIT) – China uses a progressive IIT rates ranging from 3% – 45% for individuals’ comprehensive income, 5% – 35% for individual’s income from operations (e.g. income derived by private industrial and commercial activity; sole proprietorship; etc.), and fixed rate of 20% for other incomes (e.g. interest, dividend, incidental income etc). For comprehensive income, such as wages and salaries, China’s IIT law provides a standard annual deduction of RMB 60,000 and additional itemized deductions available to all individuals.

Other taxes: Resources tax, real estate tax, stamp tax, deed tax, urban construction and maintenance tax, educational surcharge, etc. – are a series of taxes or surcharges levied on specific types of transactions and business activities.

Tax Residency

All businesses and individuals, inside and outside of China, are classified either as PRC tax residents or non-PRC tax residents.

PRC Tax Resident Enterprise (TRE) – refer to an enterprise established according to the Chinese law or an enterprise established according to foreign laws but with its effective management located in China.

TREs – are taxed on all sources of income – including income derived from overseas. The TREs will be allowed to deduct the tax paid overseas within certain limits from its tax liability in China provided that a Double Taxation Avoidance Agreement (DTAA) is in place. All registered legal entities in China are automatically classified as TREs. Overseas businesses without a registered legal entity in China can still be classified as TREs if they are determined to have effective management in China.

Non-TREs – are taxed only on China sourced income. Overseas entities are generally considered to be non-TREs. Representative Offices (ROs) in China are also considered to be non-TREs as they are treated as extension of oversea entities, and only perform liaison & promotional activities in China for their oversea head offices.

Withholding Taxes for non-TREs

Withholding taxes (WHT) are levied on payments made to overseas entities (non-TREs) and must be withheld by the Chinese entity before remittance can be made.

Passive income derived by Non-TREs – including dividend, royalty, rental, capital gain, and interest are subject to withholding taxes of VAT (6 – 13% per categories) and CIT (20%, reduced to 10% under current provisions). Under a tax treaty, the WHT rates can be lower or even exempted depending on the destination country.

If the passive income is derived by a foreign individual of non-PRC Tax Resident, it is subject to withholding taxes of IIT (20%) instead.

A “Tax Completion Certificate” is provided for deducting tax paid in China from the tax liability in the oversea home countries according to the tax treaties.

Double Tax Relief

Double tax relief is granted through Double Taxation Avoidance Agreements (DTAA) signed between China and other countries and provide relief from the double taxation of income, assets, or financial transactions. They allow for tax credits to be claimed in China up to the amount paid in tax to a foreign country within the same tax category – and vice versa. DTAAs effectively reduce the taxes withheld from income or other financial transactions between two countries.

As of January 1st, 2020, China has DTAAs in place with 110 jurisdictions. It’s important to consider the implications of a DTAA before deciding on a final investment structure for your new company.

PRC Tax Filing Requirements

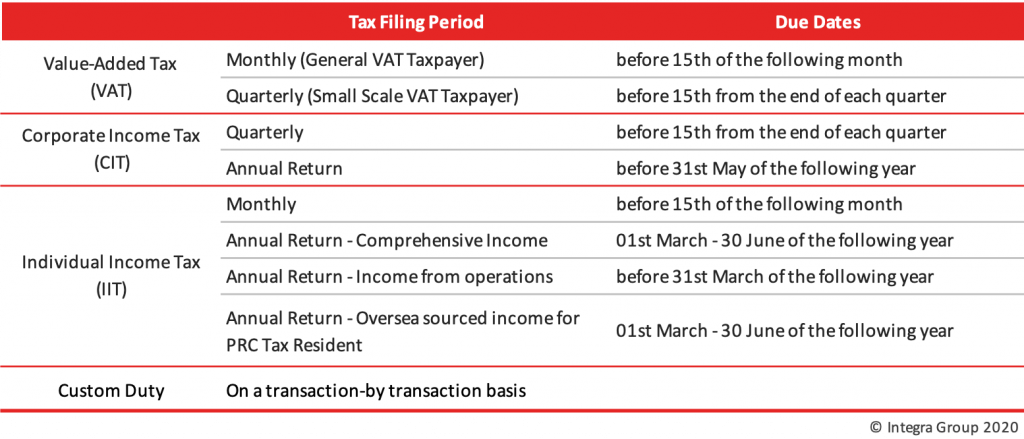

Businesses in China all have to meet monthly, quarterly and annual statutory filing requirements. Reporting and tax declaration are mostly done online, through an online tax portal for the local municipality to which your business pays taxes to.

VAT – Value added tax is filed and collected monthly for general VAT taxpayers and quarterly for small-scale VAT taxpayers – due before the 15th day of the following month or following the end of the quarter. Special circumstances may require VAT to be paid upon issuing the tax invoice (fapiao).

CIT – Corporate Income Tax is filed and collected quarterly for all businesses – due before the 15th day following the end of the quarter. An annual CIT reconciliation return is filed once per year, due before the 31st of May of the following year. Businesses should pay the tax shortage or claim back any overpaid taxes during their annual return. Any tax losses may be carried forward for a period of up to five years, subsequent to the year of the loss.

IIT – all individuals are required to file and pay individual income taxes before the 15th day of the following month, either withheld by the withholding agents (e.g. the employers) or through self-declaration by the taxpayers. Individual PRC Tax resident who meet specific criteria must also file an annual tax reconciliation return between 01st March and 30th June of the following year for their comprehensive income.

Preferential Tax Treatments

China adopts “predominantly industry-oriented, limited geography-based” tax incentive policy, aiming at directing investments into those industry sectors, projects or regions which are encouraged and supported by the State.

Industry-oriented: Agriculture, forestry, animal-husbandry and fishery projects; Specified basic infrastructure projects; Environment protection, energy conservative projects; qualified new/high tech enterprises etc.

The tax incentive policies mainly include tax reduction and exemption, reduced tax rates, and additional tax deductions.

Tax in China, like everywhere in the world, can create difficulties for any business, whether it be cashflow or retaining profits. Through proper tax planning activities and a long-term approach, investors are able to best manage the amount of tax their business pays and generate an overall greater return on their investment. For more information on PRC tax compliance and applicability to your business situation, we suggest seeking the help of a tax professional.