China has a unique system for determining the registered capital requirements for businesses. Although there are no mandatory minimum registered capital requirements specified for all intents business purposes, some specific industries maintain a minimum registered capital requirement in China. It’s important to note that while a minimum may not be required by law, businesses may choose to settle upon a higher registered capital to ensure that the business has sufficient funds to maintain the day-to-day activities of the Company.

Registered capital can be thought of as subscribed capital without any deadline for shareholders to inject said capital into the company. Unless a minimum registered capital is specifically stated by laws and regulations, investors can determine a registered capital based on their business needs and provide said capital according to their cash requirements. This is normally written in the Company’s articles of association the period to top-up the registered capital.

Ultimately, the registered capital’s purpose is to provide investors with the means to supply the necessary funds for the business to operate and fulfill its obligations. Thus, it is important to consider the business requirements when deciding on the amount of capital required at the setup stage of the company.

How much registered capital do I need?

The registered capital is the primary funding used to cover the costs of establishing and operating the business until it can be self-sustaining.

One important factor to consider is the type of business that the company will be engaged in as different types of businesses may require different amounts of investment. For example, a manufacturing company may require a larger amount of capital than a service-based business, as it will need to purchase equipment and materials. It is also important to consider the potential growth of the business and the amount of capital that will be needed to support this growth.

As a general rule of thumb, we recommend a minimum budget of 6 months of operating expenses as the registered capital.

Industry Specific Minimum Registered Capital Requirements in China

In the case where certain industries require, by law, to maintain a minimum registered capital, these requirements are in place to ensure that businesses have sufficient funds to operate and fulfill their obligations. They generally include industries with numerous stakeholders across supply chains and those with important roles in society and the economy.

Other Minimum Capital Requirements

Additionally, the registered capital requirement will also be influenced by the size and structure of the company. For example, a business with operations at the provincial or state level may title their company name “Province”, or “China” in it. As this type of company has businesses spanning different cities and provinces, the minimum capital requirement as set by the Administration for Market Regulation will be higher. In addition, specific industries like labor dispatching or headhunting service companies have certain minimum capital requirements and certifications to be met before businesses can be carried out.

Example:

XYZ Group Textile Manufacturing (Jiangsu) Co. Ltd.

or

XYZ Group Textile Manufacturing (China) Co. Ltd.

Types of Capital Contributions

Normally, there are two methods that investors can use to contribute capital. These methods are cash contribution and contribution in-kind.

Cash contribution

Cash contribution is the most common method of contributing capital in China. In this method, the company’s investors provide the required capital in the form of cash paid to a special capital account belonging to the company. This capital can then be freely used to cover business expenses such as purchasing products, paying staff, rental expenses, and advertising.

Notably, the monetary capital contribution of all shareholders shall not be less than 30% of the registered capital of the limited liability company.

In-Kind Capital Contribution

Contribution in-kind refers to the company’s investors providing assets or property to the business in lieu of cash. These assets or property are then used by the business in its operations and/or to generate revenue.

To provide in-kind capital contributions in China, the company must determine the fair value of the property, goods, or other assets being contributed by the shareholder. This is typically done by a professional appraiser or using other methods such as market value, cost value, or net asset value. The value of the capital contribution in-kind must also be recorded in the company’s articles of association and the shareholder must provide proof of ownership.

Total Investment and the Foreign Debt Quota

In China, companies are permitted to register foreign loans in addition to the registered capital

up to a prescribed limit known as the ‘foreign debt quota’. In order to register a foreign loan, the company should state a total investment that is greater than the registered capital on the article of association. The difference between the total investment and the registered capital is the amount to be registered as a foreign loan.

Total Investment = Registered Capital + Foreign Loan

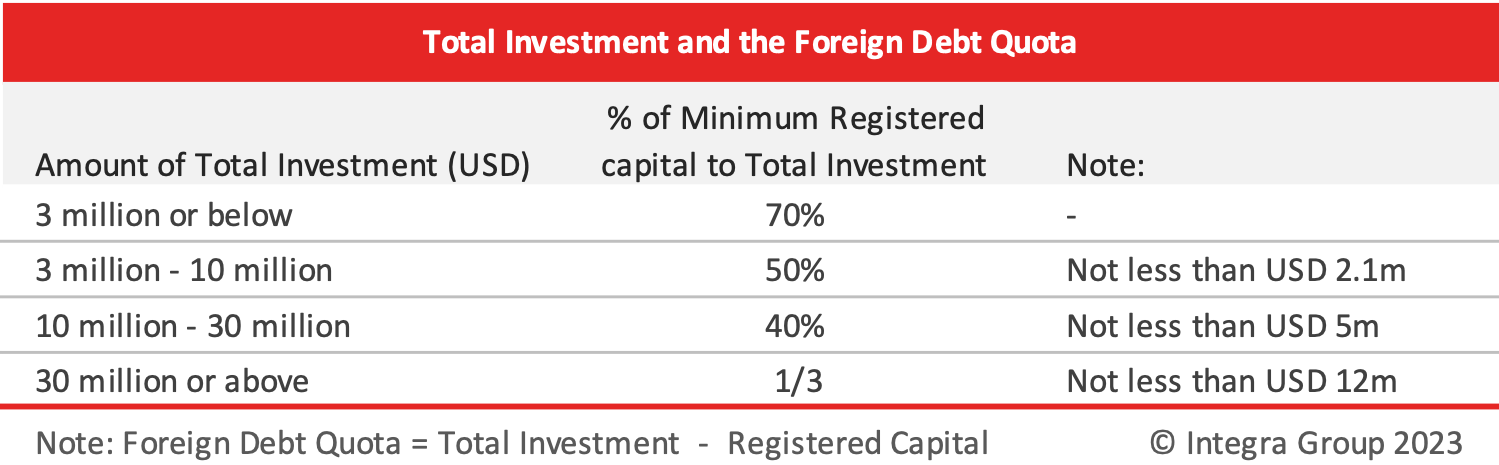

The foreign debt quota for companies in China is interlinked with the registered capital amount. In other words, the debt-to-equity ratio for foreign invested enterprises in China is limited by law. As the amount of registered capital increases, so does the debt-to-equity ratio according to the following table

Macro-prudential Method

Additionally, enterprises can choose to apply the Macro-prudential Method for calculating the upper limit of the amount of foreign debt they are permitted to register (Yingfa [2017] No. 9). The Macro-prudential Method may allow the enterprise to register a foreign loan greater than what is permitted under the standard Foreign Debt Quota and must be submitted to the SAFE for approval.

The Macro-prudentual Method uses the following formula to determine the upper limit of the amount of foreign debt allowed for registration.

Can I decrease my registered capital in China?

Should the investor(s) of a company in China decide they would like to decrease their investment in China, they are able to do so. The company can return part of the capital investment to the shareholders and decrease the registered capital.

To decrease the registered capital of a business in China, the company must submit a request to the Administration for Market Regulation (AMR). This involves completing and submitting a registered capital decrease application together with supporting documents including the shareholder resolution, a balance sheet and a list of assets, and other relevant materials. The AMR will review the request and, if approved, issue a certificate of registered capital reduction and updated business license. The company must then complete the additional steps required, such as making changes to its articles of association and updating the business license with the bank and other institutions.

Important considerations when deciding the registered capital

Shareholder liability for unpaid capital

In China, shareholders are typically liable for their registered capital in a company limited by shares, up to the amount of their registered capital contribution. This means that the shareholders are personally responsible for the amount of capital they have agreed to contribute towards the company’s registered capital, and they may be required to pay this amount if the company is unable to fulfill its obligations. However, the liability of shareholders for their registered capital in China is not without limitation and may vary depending on the specific circumstances of the company.

Statutory Reserve Fund

The statutory reserve fund refers to the mandatory fund which companies must pay into when distributing dividends. When the company pays a dividend, it must set aside 10% of the total amount into a statutory reserve up to an amount equal to 50% of the registered capital.

The statutory reserve can be freely injected back into the company at any time by means of increasing the registered capital, however, it’s mandated by law as a “rainy day” fund for companies in China.