Hong Kong has developed itself into a popular hub for international companies doing business in Asian markets – and for good reason. Hong Kong provides a low tax jurisdiction and business-friendly legislative environment which has earned it the title of 3rd easiest place in the world to do business. Hong Kong’s territorial tax system also provides a particularly favorable environment for companies located in Hong Kong, but conduct business outside of Hong Kong, making it a befitting location for holding companies.

A holding company is a legal entity whose primary purpose is holding a controlling share in another company or multiple companies. While a holding company is often used for consolidating ownership, it may also provide management functions and play a role in coordinating group-level activities.

In many cases, a Hong Kong holding company allows enterprises to enjoy tax benefits and ease of doing business in Hong Kong while also providing structural advantages.

Companies and foreign investors looking to set up a company in Hong Kong and enjoy the many benefits of Hong Kong, including those provided under different tax treaties, are encouraged to first acclimatize themselves with the compliance requirements and determine a suitable business structure in advance.

Advantages of a Hong Kong Holding Company

Hong Kong’s business-friendly legislature provides benefits for holding companies’ set up within the jurisdiction ranging from tax incentives to flexible group structure.

It is important to note that many of the benefits offered in Hong Kong are not granted by default and require the business to maintain a good compliance status before one can apply for them.

Preferential tax rates

Hong Kong adopts a territorial tax regime, meaning only profits generated within Hong Kong are taxed in Hong Kong and profits derived from an offshore source are tax exempt in Hong Kong.

Profits which have a source in Hong Kong, the profits tax rate is low. The standard profit tax rate in Hong Kong is 16.5%, comparatively lower than the standard profit tax rate of 25% in Mainland China (referred to as Corporate Income Tax). In addition, the first HK$2,000,000 taxable profits, generated within Hong Kong, are taxable at a reduced profit tax rate of 8.25%.

Furthermore, dividends paid from a Hong Kong company are not subject to any withholding tax. In other words, dividends paid from a Hong Kong company, including dividends paid using profits from an offshore source, can be remitted in full to shareholders.

Hong Kong DTAs and tax treaties

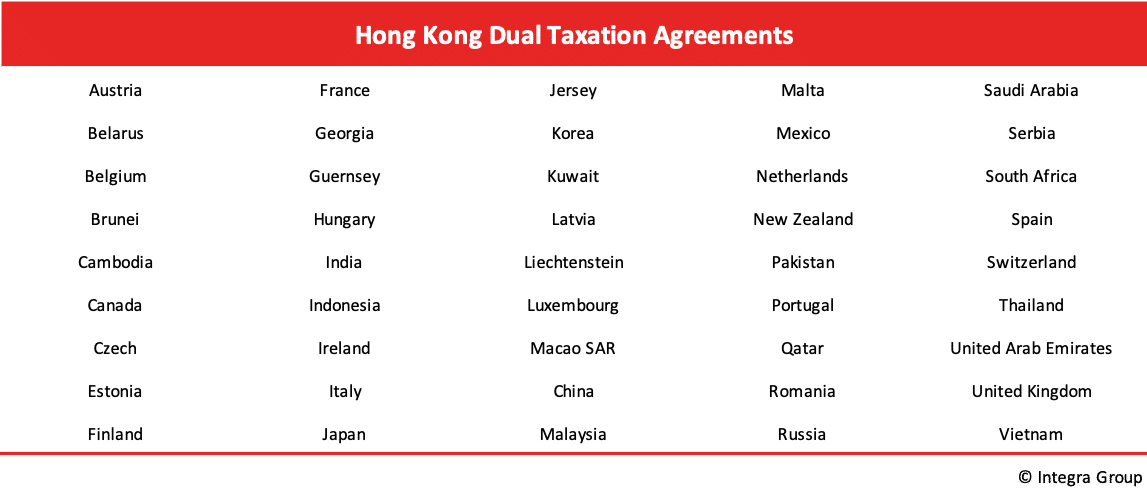

Hong Kong also maintains extensive Dual Taxation Agreements (DTA) with over 44 countries and the Macao Special Autonomous Region. These tax treaties provide companies relief from double taxation and, in some cases, preferential tax rates for companies who meet specific criteria (see Tax Treaty Compliance below).

For example, the DTAA between Mainland China and Hong Kong provides a reduced withholding tax rate of 5% (down from 10%) on dividends and a reduced rate of 7% (down from 10%) for royalties and interest payments made by the Chinese company to the Hong Kong entity.

A detailed list of DTAAs signed by Hong Kong can be found here.

Cash Pooling

A Hong Kong holding company can function as an agent of the group facilitating the management of capital between related subsidiaries without significant tax leakage. The group can consolidate funds via the Hong Kong company and re-allocate them to subsidiaries as required – bypassing the need for remittance to the parent company where the tax is often higher.

Compliance for Hong Kong Holding Companies

Following the OECD Base Erosions and Profit Shifting (BEPS), tax authorities across the world have begun cracking down on aggressive tax planning activities which are performed primarily on the basis of obtaining a tax advantage/benefit and lack sufficient business substance.

The OECD sets out that “although some of the schemes used are illegal, most are not.” Thus, it’s important that when transacting through a group company in a low-tax jurisdiction to follow the administrative and filing requirements carefully to ensure compliance across all jurisdictions.

Transfer Pricing

Multinationals who regularly engage in related party transactions are required to comply with local transfer pricing regulations. When determining the transfer pricing of goods or services, including Intellectual Property transfer, between group companies, they must ensure such transactions are carried out in accordance with the arm’s-length principal.

It’s important to ensure the supporting documents which are relied upon demonstrate the arm’s-length pricing include the reasoning and assumptions made to support the transfer pricing methodology.

Good documentation helps ensure that parties within the group can obtain reasonable profits while maintaining compliance across companies within the group.

Tax treaty compliance

The OECD BEPS sets out a framework for governments to crack down on tax treaty abuse by which companies seek to obtain benefits of a tax treaty between two countries other than their home country. Thus, individual tax treaty members are tasked with implementing local regulations for preventing tax treaty abuse and such rules and regulations can vary between countries.

For example, the China-Hong Kong DTA states that dividends, royalties, and interest are taxed at a preferential rate provided that the Beneficial Owner (BO) is a resident of Hong Kong.

In the example of the China-Hong Kong DTA, China determines the BO status of the Hong Kong company through criteria set out in the SAT Bulletin on Matters Concerning “Beneficial Owners” in Tax Treaties (SAT [2018] No.9 (Hereinafter Bulletin 9)).

Bulletin 9 states that one of the criteria by which a company can qualify for BO status is if it has carried out substantiative business activities in the jurisdiction, the scope of which includes substantive manufacturing, trading, and management activities. Within this scope, investment management is considered substantive management activities based on the functions performed and the risks assumed by the company.

Pierre Wong, Managing Director of Integra Group, explains “tax treaty regulations are amongst the most complex tax regulations to plan around. Purely holding companies, or shelf companies, are highly unlikely to pass the test of tax authorities. Thus, it is critical for Hong Kong holding companies to be able to demonstrate some business purpose or substance to successfully apply for tax treaty benefits.”

How to prepare

While Hong Kong clearly provides many benefits to resident companies, fully taking advantage of these benefits requires businesses to maintain a good compliance status. Furthermore, companies looking to implement a Hong Kong holding company into their group structure should seek advice specific to their business situation from a qualified tax professional.

For more information on setting up a Hong Kong holding company and compliance for Hong Kong holding companies contact us.